Managing your business finances, tax obligations, and audit requirements is essential for compliance, growth, and long-term success. Our Accounting, Tax & Audit Services in London are designed to support startups, small businesses, and growing companies with accurate reporting, timely submissions, and expert guidance.

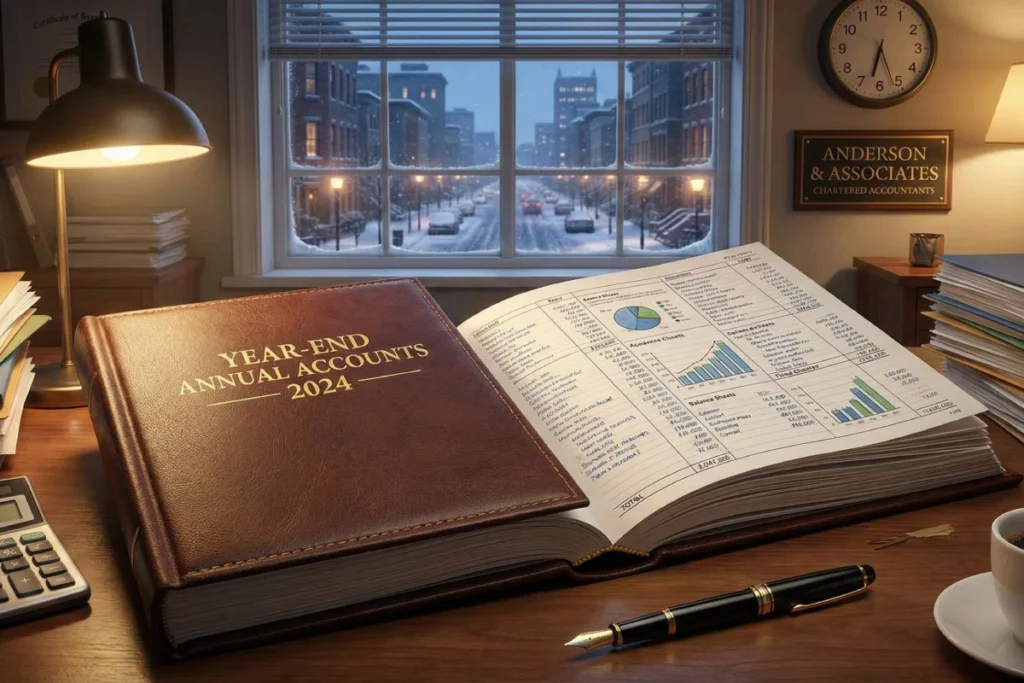

We take care of complex financial and regulatory tasks so you can focus on running and growing your business with confidence. From preparing annual accounts to filing corporation tax returns and conducting audits, our experienced team ensures everything is handled professionally and in line with UK regulations.

Corporation tax can be complex, and mistakes or late submissions can result in penalties. Our Corporation Tax Return service ensures your tax obligations are handled accurately and on time.

We calculate your corporation tax liability, apply all eligible reliefs, and submit your return to HMRC, ensuring full compliance.

Choosing the right accounting firm is crucial for the financial health and compliance of your business. Our Accounting, Tax & Audit Services are designed to provide reliable support, accurate reporting, and expert guidance at every stage of your business journey. We work closely with startups, small businesses, and growing companies in London to simplify complex financial processes, ensure compliance with UK regulations, and help you make informed business decisions with confidence.

Audits provide independent assurance that your financial statements are accurate and compliant with UK regulations. Whether you require a statutory audit or a voluntary audit, our professional audit services deliver clarity and confidence.

Our Accounting, Tax & Audit Services are designed to make financial management simple, compliant, and stress-free. Whether you need year-end accounts, corporation tax support, or audit services, our expert team is here to help.

Book a free consultation today and let us take care of your accounting, tax, and audit needs.

Book your free consultation with Calendly and discover tailored strategies to elevate your success.

Year-end annual accounts summarise your business’s financial performance for the year. They are legally required for most UK businesses and help ensure compliance with HMRC and Companies House while giving you a clear view of your financial position.