Managing VAT, compliance obligations, and financial planning is essential for maintaining control and supporting business growth. Our VAT, Compliance & Financial Advisory Services help London businesses meet HMRC requirements while gaining clear financial insight for better decision-making.

We support startups, small businesses, and growing companies with accurate VAT returns, Making Tax Digital compliance, and practical cashflow and forecasting advice, helping you stay compliant and financially confident.

VAT returns must be prepared accurately and submitted on time to avoid penalties. We manage the complete VAT return process, ensuring your figures are correct and fully compliant with HMRC regulations.

Making Tax Digital is a legal requirement for VAT-registered businesses. We help you transition smoothly to MTD-compliant systems and ensure ongoing digital record-keeping and submissions.

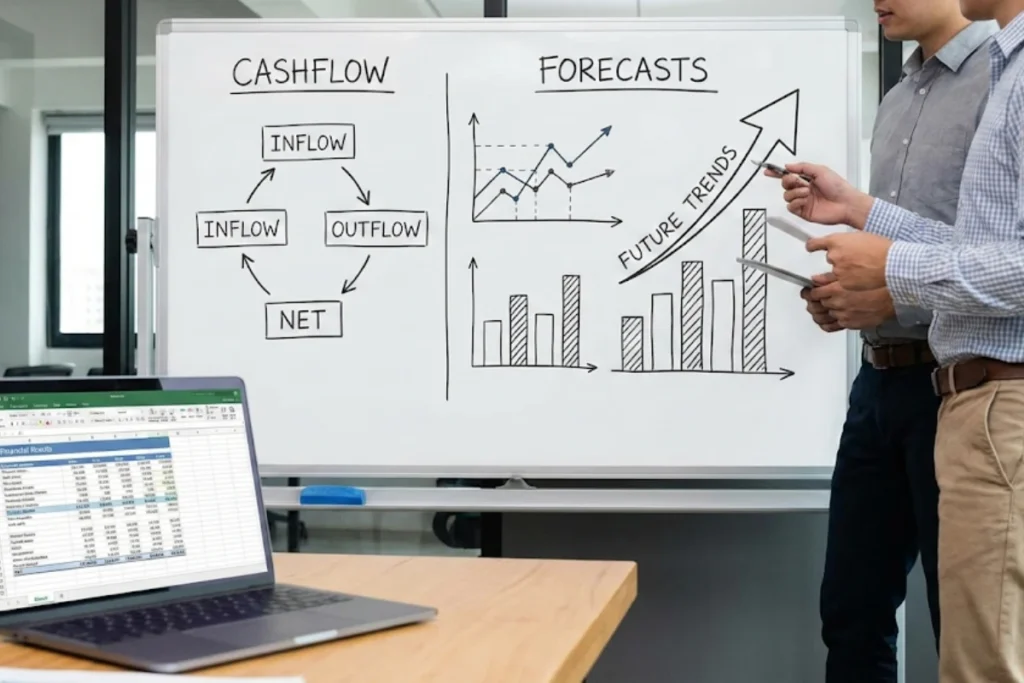

Understanding your cashflow is key to business stability and growth. We provide clear cashflow management and forecasting to help you plan ahead and make informed financial decisions.

Our VAT, Compliance & Financial Advisory Services help businesses stay compliant, organised, and financially confident. We support startups, small businesses, and growing companies in London with accurate VAT reporting, Making Tax Digital compliance, and clear cashflow and forecasting advice, ensuring better financial control and informed decision-making.

Our VAT, compliance, and financial advisory services are designed to support businesses with accuracy, clarity, and long-term financial stability. We help you meet HMRC requirements while improving financial control and decision-making.

We ensure your VAT calculations are accurate and your returns are submitted on time. Our approach reduces the risk of errors, penalties, and HMRC enquiries, giving you confidence that your VAT obligations are fully under control.

Making Tax Digital compliance can be challenging, especially for small businesses. We ensure your systems, records, and VAT submissions fully meet MTD requirements, helping you stay compliant without disruption to your operations.

Understanding cashflow is critical for business survival and growth. We help you monitor incoming and outgoing cash, identify potential shortfalls, and maintain healthier cashflow to support day-to-day operations.

With accurate financial data and expert insights, you can make better business decisions. Our advisory services help you plan ahead, manage risks, and take advantage of growth opportunities with confidence.

We offer clear and fixed pricing with no hidden costs. This allows you to budget confidently for VAT, compliance, and advisory services without worrying about unexpected fees.

By outsourcing VAT, compliance, and financial planning to experienced professionals, you free up valuable time. This allows you to focus on running your business, serving clients, and driving growth.

Our VAT, Compliance & Financial Advisory Services are designed to help businesses manage VAT obligations, meet HMRC compliance requirements, and gain clear financial insight. Whether you need VAT return support, Making Tax Digital compliance, or cashflow and forecasting advice, our expert team is here to help.

Book a free consultation today and let us support your business with reliable VAT management, compliance, and financial planning.

A VAT return shows how much VAT you have charged customers and how much VAT you have paid on business expenses. Submitting accurate VAT returns on time is essential to stay compliant with HMRC and avoid penalties.

Yes, all VAT-registered businesses must comply with Making Tax Digital, regardless of turnover. We help ensure your business meets these requirements smoothly.

Yes, we assist with selecting, setting up, and managing MTD-compliant software, ensuring your digital records and VAT submissions meet HMRC standards.

Late or incorrect VAT returns can result in penalties, interest, and HMRC enquiries. Our service helps reduce these risks by ensuring accuracy and timely submission.